-

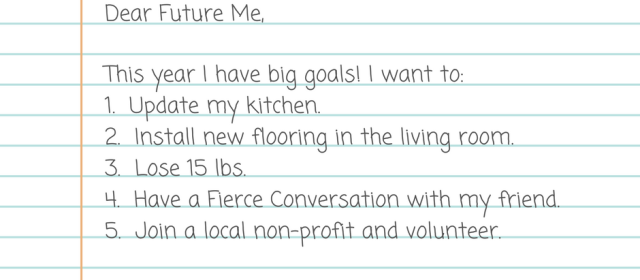

Five New Year’s Resolutions for Your Home

January 5, 2018 /I love that each year New Year’s Day and the month of January bring transformation, renewal, and possibility. As everyone returns to work after the holiday bustle and the weather in Seattle remains chilly and gray, the world feels quiet and peaceful. While we tend to focus on New Year resolutions that have to do with career, health, happiness, etc, we often overlook resolutions for one of the most important spaces in our lives–our homes. Setting and achieving goals for your home can significantly improve your finances and your general wellbeing (for more about the connections between architectural spaces and mood, check out this fascinating article). Here are a few of our favorite New Year’s resolutions for your home in 2018. 1. Create a budget for home improvements. Because it’s easy to rack up credit card charges when working on home improvement projects, this is the best place to start. Create a list of projects in order of priority. Be sure to devise a home improvement budget each year–HouseLogic suggests that the owner of a $250,000 home set aside $2,500 to $7,500 per year for maintenance and repairs. 2. Cut your energy use. Energy Star has an informative guide to…Read more

-

How to Take the Leap and Invest: A Conversation with Cody Touchette

December 7, 2017 /While investing in real estate is one of the best ways to build wealth, getting started can often feel intimidating. However, this exciting process is much more accessible than you think. In fact, one of my favorite parts about writing for Pickett Street has been learning from their wonderful team and realizing that investing in real estate is not just for experts in real estate and finance. I was recently able to talk with Cody Touchette, who is a mortgage planner with Caliber Home Loans and provides clients with expert guidance during their home financing processes. Here’s what he had to say. 1. Why is investing in real estate a worthwhile endeavor? According to Cody, there are four main benefits to real estate as an investment: cash flow, appreciation, leverage, and tax benefits. First, investing in real estate through buying your own home, purchasing a property to rent to others, or other options, is a great way to receive immediate cash flow that can help you purchase more property. Second, regarding appreciation, Cody reminded me that real estate has always increased in value over time, if you look at a long period or time. While the market experiences normal ups and downs, appreciation on real…Read more

-

Pickett Street Properties Gives Gratitude for 2017

November 21, 2017 /My favorite part about Thanksgiving is the chaos: family members bickering while on hour three of Settlers of Catan, something burning in the oven, the dog stealing turkey off the counter, a holiday song sung terribly out-of-tune. These sweet, funny moments of imperfection are, I believe, life in its purest form. They remind me of all the people, relationships, and tiny moments for which I feel grateful. So, in the spirit of the season, let’s talk about gratitude. Multiple scientific studies have shown that gratitude improves sleep, psychological health, and physical health. Basically, gratitude is one of the keys to a happy life. I recently interviewed the Pickett Street team to find out what they’re grateful for this year. I’ll start. I’m grateful for my partner, who makes me coffee and brings it to me every single morning (seriously, what a hero!), for my healthy body that lets me do yoga and climb mountains, for my undergraduate students, who are funny and inspiring and give me hope in the world, for the great companies with which I work (such as Pickett Street!), and for my sweet dopey pitbull puppy. Here’s what the team at Pickett Street had to say. Christi Samaniego, Listing Coordinator…Read more

-

Green Lake: Neighborhood Profile

November 16, 2017 /The Green Lake neighborhood is nestled in the heart of north Seattle, surrounded by the Fremont, Ballard, Wallingford, Ravenna, and Greenwood neighborhoods. I have fond memories of spending long afternoons at Green Lake as a child, feeding the ducks and playing in the mud with my brothers (i.e. throwing mud at my brothers). Afterward, we would always pop into one of the many nearby coffee shops where my parents would buy us flavored steamed milk so my brothers and I could pretend that we, too--even at the tender ages of ten, eight, and four--were sophisticated, coffee-guzzling Seattle-ites. That was back in the nineties, and today, Green Lake is more bustling and hip than ever before. Here are the details on one of Seattle’s most beloved neighborhoods. Real Estate Stats According to Niche, the median home value in Green Lake is $581,057, and the median rent is $1,418. This neighborhood is great for single individuals, couples, and families. Many homes in Green Lake fall under the architectural category of the classic Seattle Box or Four Square home, which features two stories, an inset front porch, and a simple yet chic geometric form. If you’re interested in buying or selling a home…Read more

-

Millennials and Technology: How the Housing Market is Changing

November 16, 2017 /The other day I caught myself doing a very millennial thing: I needed new winter boots, and, not surprisingly, I quickly spiraled down an obsessive rabbit hole of internet research. Before I knew it, I had roughly fifty tabs open, two hours had passed, and I still hadn’t purchased any boots. True to my millennial nature, I am extremely careful with my money, and I don’t like to own a lot of stuff. Consequently, it’s important to me that my purchases last a long time. This millennial attitude, along with Americans’ contemporary reliance on technology, is changing many things, including the housing industry. Here’s more information about recent trends in buying homes. 1. Millennials have started to buy homes. You might have noticed a pattern in headlines over the past few years: “Why Millennials Aren’t Buying Diamonds,” “Why Millennials Aren’t Buying Homes,” or, my personal favorite, “Why Millennials Are Addicted to Avocado Toast” (spoiler: because it’s delicious!). One of the main reasons millennials have been slower to buy homes than previous generations is that life is more expensive than it used to be. College tuition costs are rising more quickly than financial aid, and 83% of millennials say that student…Read more

-

An Interview with Margaret Smith on Confidence and the World of Real Estate

November 9, 2017 /This week marks the fifth anniversary of Pickett Street’s Margaret Smith. Though I’ve only been working with her for about six months, I’ve already come to know Margaret as a positive and hardworking force of nature. Margaret is the Director of Operations for Pickett Street Properties; she recruits, screens, and interviews candidates and manages social media, client events, system evaluation, branding/marketing, and overall growth and planning for Pickett Street. I was recently lucky to be able to chat with her about her experiences in the world of real estate. Hi Margaret! Congrats on five years of working with Pickett Street. Can you talk to us about how you started working for Pickett Street? Before Pickett Street I was the Docent Program Coordinator for the Seattle Art Museum. I NEVER thought I would work in sales or for a sales company--and now I can't imagine anything else in my future. This career gives me an opportunity to help and inspire people in a much bigger way and through a bigger platform than I ever imagined. I was ready to leave the museum because I wanted a career where I could support myself financially, and that's hard to do in the nonprofit…Read more

-

Buy now, my pretties!

November 3, 2017 /While Halloween and its festivities can be super fun, this holiday may have put you in a spooked mood. Am I the only one out there who regrets spending Halloween huddled on the couch, mindlessly eating Reese’s peanut butter cups and watching The Shining? While Jack Nicholson wielding an axe is certainly terrifying, most adults experience more anxiety over certain aspects of everyday life, including financial commitments like career decisions and buying a home. (Quick side note, another common fear is robots taking over the world.) If anxiety over buying a home sounds familiar, not to worry--this decision is not as scary as it seems. To soothe your fears and ease the process, get in touch with Pickett Street (425) 502-5397 or info@pickettstreet.com. In the meantime, settle in with that leftover Halloween candy (unless you ate it all like me), and relax by reading about common home-buying fears and why they’re not actually that scary. 1. Buying a home costs too much money, and I can’t afford it. Finding enough cash to make a down payment on a home is one of home buyers’ biggest anxieties. The median home price in Seattle is $725,000, which means that a 20% down…Read more

-

New Listing Near the Arboretum Is a Seattle Dream

October 5, 2017 /Here’s a nerdy confession: one of my favorite ways to relax is to sit down with a cup of coffee or a glass of wine and drool over home design makeovers. I love to read about how people buy homes and make them their own with just a bit of design smarts, such as this inspiring example on Cup of Jo. As such, I am thrilled to talk about Pickett Street’s newest listing today, and am both jealous of and excited for the lucky homebuyer who snags this property. The Listing While searching for your dream home can sometimes be discouraging, there also comes the time when, by some miracle, you find the perfect spot. Just four blocks from the Arboretum, this four-bedroom, three-bathroom historic home was built in 1904 and is oozing with charm. Highlights include a spiral staircase, a fully finished daylight basement with a cozy wood stove, crafted cabinetry, a jetted tub in the master bathroom, and the unbeatable location. The best part about this property is that, at a spacious 4,000 square feet, with two levels and the finished basement, the property is begging to be customized to fit your style and needs. The basement’s private…Read more

-

Four Reasons Why It’s Good to Be a Home Seller Right Now

September 29, 2017 /My friends recently made a really smart real estate decision: four years after purchasing their lovely home in Boulder, Colorado, they sold it and moved to a cheaper spot in Nashville, and, as a result, made a boatload of money. I found myself both--let’s be honest--slightly envious, and inspired. Investing in real estate, and understanding when to sell, is one of the smartest ways to build wealth. You might be wondering what Boulder, Colorado has to do with Washington State, aside from the fact that both Seattle and Boulder are home to hippies and tech nerds with serious outdoors obsessions. Well, while Boulder’s real estate market is doing well right right now, Seattle’s real estate market is right up there with it as one of the most competitive markets in the country. In many ways, the Seattle market is even hotter than Boulder’s. If you’re considering listing your Seattle area home right now, here are a few reasons why it's good to be a home seller right now. For more information about selling your home and understanding its current value, contact Pickett Street at (425) 502-5397 or info@pickettstreet.com. Also, be sure to check out this easy home value form. 1. The…Read more

-

Neighborhood Profile: Kenmore’s Transformation into a Vibrant Community

September 21, 2017 /Three large industrial silos sit on the edge of Kenmore, and the town’s residents are about to transform these towers into art. For the past year, residents have posted signs on these silos that read “Let’s Beautify This,” urging passers-by to donate to a GoFundMe account. This project speaks to both Kenmore’s current exciting revitalization and its strong sense of community. Located northeast of Seattle on the tip of Lake Washington, Kenmore is an up-and-coming, medium-sized town. Here’s some more information on why this is a great spot to buy a home right now, along with a humble suggestion of a listing you might love. Real Estate Stats The median home value in Kenmore is $559,300, and the median rent is $1,896 per month. I’m currently drooling over this gorgeous two-level condo in Kenmore with three bedrooms, including a spacious master bedroom that has a bathroom with double sinks (you’ve know you’ve made it in life when you have two sinks in your bathroom). The condo also has an updated kitchen with laminate countertops and a cozy gas fireplace for those long northwest winters. Also, how great would it be to drink your coffee each morning on this cute deck…Read more

-

Look For The Helpers

September 15, 2017 /If you’ve been following the news lately, or if you’ve been directly affected by recent events, it might seem like the world has turned into an apocalyptic landscape. With wildfires in Oregon, California, Montana, and elsewhere, and Hurricane Harvey and Irma ripping through the southern United States and Caribbean, it’s easy to feel overwhelmed. In difficult times, I am reminded of a quote from the beloved Mr. Rogers: "When I was a boy and I would see scary things in the news, my mother would say to me, ‘Look for the helpers. You will always find people who are helping.’ To this day, especially in times of disaster, I remember my mother's words and I am always comforted by realizing that there are still so many helpers--so many caring people in this world." The Keller Williams family is among the many helpers. How Keller Williams Is Helping As Hurricane Harvey’s devastation spread, leaving at least 210,700 properties damaged or destroyed in Texas, many displaced survivors looked for shelter at the Austin Convention Center, where Keller William's company typically holds a four-day conference each year in September. After seeing how many people needed support in the hurricane’s aftermath, Keller Williams decided to…Read more

-

How Owning a Home Builds Wealth

August 17, 2017 /Here’s something I wish I’d known in my early twenties: buying a home is one of the best ways to build wealth. In 2015, according to the Federal Reserve, the average homeowner’s net worth was $195,400, while the average renter’s net worth was $5,400. Perhaps you know all of this already and are wondering if buying a home is still, in the current economy, even after the 2008 housing crisis, one the best wealth-building strategies. The answer to this question is yes, and here are a few reasons why. 1. Owning a Home Builds Equity and Forces You to Save Home equity is an asset that comes from owning a home and represents one of the largest sources of net worth for most investors. In other words, equity is the portion of your home that you actually “own.” Of course, when you a buy a home you own all of it, but borrowing money to buy your property means that the seller still has an interest in it until you pay off the loan. Equity is essentially a form of wealth; you can eventually take out income or lump sum withdrawals from this asset, or you can pass it on…Read more