-

The Value of Taking the Long View

July 2, 2008 /If you pay attention to any real estate related news headlines these days, it certainly sounds like THE SKY IS FALLING!. It seems the safest option would be to sit on your predictably rising average rent payment of $1350/mo., and wait for interest rates, the cost of living, gas, and housing to drop back to where they should be. That's what I would have done- 14 years ago. Or at least that was my plan. My wife had other ideas. We'd been paying $690/mo for an 1100sf 2 bedroom, 1-3/4 bath Wedgwood apartment. It was a block from the local Safeway, the bus stopped at the front door, and was within easy reach of downtown Seattle. We were comfortable, and after 3 years there, I saw no sense in nearly doubling our housing allotment to over $1200/mo. (We didn't have much of a down payment) to move 12 miles away, into the 'burbs', or as our Ballard friends called it, "Canada". We saw about 35 homes before our agent, Linda, called one evening to say, "this is it, it's just come on the market, and you'd better run up here to see it, now!" We'd familiarized ourselves with the area…Read more

-

Free Diamonds!

June 23, 2008 /Have you got a dream? I mean a gnaw-at-your-brain, tried-to-forget-it, leave-me-alone kind of wishful fantasy that fires your imagination some days, and tantalizes you with its out-of-reach nature on others. Many of us here in the Northwest, in spite of having seen our share of liquid sunshine, are still drawn to the many lakes, streams, rivers, and salt water frontages that abound in our glorious corner of the world. There is something primal about the urge to live near water- it's truly a gut level need for many. I count myself among those who dream of waking to the sight of a sailboat bobbing at anchor outside my own front door, or stepping off the deck of my small fishing cabin, fly rod in hand, for a day on the stream. I alternate between these twin romances and honestly couldn't choose between them if my life depended on it. A former client of mine had a term for the dancing flickers of light refracted off water that define the essence of the waterfront experience: He called those flashes and sparkles "free diamonds". I love the evocative image of that phrase, as it encapsulates for me the dream of finding a…Read more

-

Surveying the lending landscape

June 18, 2008 /Whether we are representing a buyer or seller, as Realtors it is our job to keep on top of what is going on in the mortgage industry. There has been a lot of press about the changes occurring within the lending arena, but even the news has a hard time keeping up with the extremely fluid nature of lending today. I think it would be safe to say that the mortgage brokers themselves have a real challenge in “knowing” what is going to happen from day to day. First, let’s get this out of the way: “Zero Down” loans are no longer in existence. “No Income Verification/No Asset” (NINA) loans with small down payments have gone the way of the dodo bird and dinosaur. Fogging a mirror will no longer qualify you for a mortgage. While this makes getting a loan more difficult, perhaps it’s all for the best. Lenders actually should want to be sure that their borrowers can afford to pay them back. If you would like to hear a very interesting commentary on exactly how we ended up in this mortgage crisis, click HERE. In fact, let’s not forget, it wasn’t all *that* long ago that 20%…Read more

-

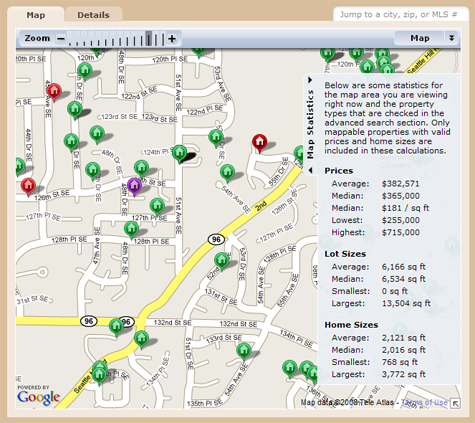

A better way to search the NWMLS

June 2, 2008 /I just returned from a trip to my hometown, Miles City, Montana. A friend of the family’s had just made an offer on a home, which they had come across thanks to the ability of their agent. In Miles City there is no MLS as we know it, no catalogue of listings, either bound or online. There are only a few websites with listing information, and these are not comprehensive. Things truly are done more word of mouth around here, which means that if a consumer wants information on a home for sale, going online isn’t going to help them. This obviously isn’t the case for us in the Puget Sound. Not only can we not find a single-family residence on four city lots for $92,000 (as my family friend did), but new listing information is available on several thousand websites. Since most of the general information is the same on all of these sites, the real issue involves usability: which site is the most intuitive? The least invasive? The most informative? The fastest? Which brings us to PickettStreet.com. After months of comprehensive searching , we came across the holy grail in the property search engine realm. The solution we…Read more

-

Pickett Street Properties moves its sign

May 28, 2008 /It’s been busy times on Pickett Street, as we’ve made a few significant upgrades to our business in the interest of improving service, and providing a more enriching online experience. You may have heard: The Pickett Street Team now resides in the brand-new Keller Williams Bothell office. The reasons for the change are many, but the biggest item addressed by the change was the frustration our clients expressed in their interactions with the available property search tools. If you’ve been in the market for a property lately, you’ve likely tried out some of these online search tools. And in fact, the unfriendly user experience of those tools provided plenty of incentive for us in the quest to raise the bar; which makes this an opportune moment to put in a loud ‘thank You’ to all who offered suggestions, and provided the feedback we live by. What we came to realize was that, as agents there are advantages to membership in the largest real estate network in the world, but those advantages don’t always translate to a better experience for our clients. A ‘bigger bureaucracy’ is not generally the most creative answer to new challenges. In spite of our best efforts…Read more

-

The Future of Housing Demand

March 3, 2008 /Heard a good economy joke lately? Me neither. Everyone seems pretty down on the prospects for the immediate future of the US GDP. The dollar is down. Gold is up. Stock Market’s down… no it’s up… no….? And so it goes: it seems the harder you look for answers to where this train is headed, there’s still one more gloomy ‘bridge-is-out’ prediction up ahead. At least that’s the typical News-at-five, sell-another-ad, soundbite takeaway message. Even Bernanke can’t seem to give us anything but mystery shrouded in intrigue. And we all thought Greenspan was opaque. But, stepping away from the abyss for a minute, if you look out toward the horizon there’s the glimmer of something brighter - could it be…we do have a future!? Remarkably enough, hope comes in the form of some concrete, positive, undeniably real numbers. Seen the latest census report? Maybe you had heard - there’s a new American created every 13 seconds! In fact, with a new birth every 8 seconds and a death every 11, that’s a net gain of 3 per second. And if you clicked on the previous link, you’ve seen the dramatic counter on the US census site- we’re now a nation…Read more

-

How over-pricing a home costs sellers money

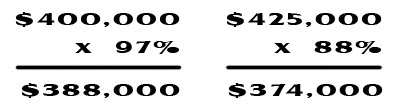

February 19, 2008 /Pricing a home for market: it very well might be the single most important element of a successful home sale, and probably the very reason most sellers should think twice before attempting to sell their home themselves. I say this as a Realtor and a home owner. No one knows better than myself the sweat and coin that I poured into my home, which my wife and I bought as a foreclosure. We had to rehab the septic system, replace the windows (all 15 of them), hang cellular blinds throughout, replace the attic insulation, sheet and replace the roof, update the kitchen, paint the exterior...well, you get the idea. Knowinig how much time and expense we put into our home, and staying aware of the neghborhood values and the lack of updates in many of those homes, it's easy for me as a home owner to assume that our home would warrant at least 6-8% more than the market average. As a Realtor, my experience tells me that I'm not objective, and my lack of objectivity might cost me money in the long run. What do I mean? Citing a collegiate study of the real estate market in California, an…Read more

-

To Market, To Market

February 4, 2008 /So, how’s the market? If there’s a defining question right now in Real Estate, that one certainly would qualify. And the undisputed champion answer would have to be: “Depends”. In the Northwest, and particularly here in the immediate shadow of employment giants Microsoft, Boeing, Weyerhaeuser, Starbucks, and the growing bio-tech industry, with players from Zymogenetics to Corixa, along with technology and gaming innovators like Microvision, Infospace & Nintendo, we have been blessed the past few years with an exceptionally strong housing market. So, when our friends in the media start trotting out housing fears as their lead story every night, it can’t help but become fodder for watercooler and cocktail party conversations across the country. Then again, if you’ve had a marketing 101 course, you know that the top 2 attention-getting drivers for advertising are #1-Sex, and #2-Fear. Recognizing that it’s not that easy making Real Estate Sexy, it’s understandable that Fear has become the currency of choice. Now, to get back to the question at hand- how is that market? Well, it depends on your needs- If you’re selling, be sure you need to sell. In a buyer’s market, sellers are at the mercy of the market, and we…Read more

-

Pickett Street posts 2007 Listings Stats

January 28, 2008 /As I write this, it’s January 28th, which means that by now, most people have broken their New Year’s resolutions, you’ve more than likely received your W-2 for 2007, and some of our clients from last year are looking forward to having something to write off for the first time! For Pickett Street it means that it’s time to look back at 2007 and look at our record. As a reminder, 2006 was a pretty good year for Pickett Street and the real estate market in general. Take a look at the stats below as a refresher: Closed Sales, King County 2006: 37,528 (down 10.48% from 2005) Closed Sales, Sno. County 2006: 16,475 (down 5.06% from 2005) Median Home Price, King County 2006: $381,463 Median Home Price, Sno. County 2006: $325,000 Overall sales in 2006 were down from 2005, but the median price was way up (almost 14% in King County, over 16% in Snohomish County). The market was stable, and there were many that reaped the benefits of this (especially sellers). The market in 2006 was conducive to Realtors as well - listed homes weren’t on the market long, and were selling at or above list price. The average…Read more

-

Take a Flyer!

January 4, 2008 /Several months ago I promised video of The PickettStreet R/C truck in action. Well, here it is! Notice that for most of the stunts shown here, the truck is wearing an alternate body. This is due to a hotly debated, but ultimately unsuccessful attempt to persuade my 6 year old daughter that I painted the 'special' body for people to see- she didn't care, and insisted that: "The Flames are my favorite" I have yet to find a suitable argument for that logic. You'll also note that while I was doing the majority of the filming, the wild stunts are courtesy of my 16 year old nephew- and to think he's now a licensed driver!Read more

-

Propaganda P-I

November 27, 2007 /Yes - as in the "Seattle Post-Intelligencer." Take this article for instance: Seattle's 12-month reign atop the nation in annual home-value increases came to an end in September, according to a report released Tuesday. Charlotte, N.C., posted a year-over-year increase of 4.72 percent, just ahead of Seattle's 4.69 percent, according to Standard and Poor's S&P/Case-Shiller Home Price Indices. To the informed mind, this might sound like good news: despite a falling American dollar, despite the collapse of the sub-prime mortgage market, despite national news reporting falling home prices across the nation, home values in our area continue to rise! Not at the meteoric rate that we had seen over the past four years - but who really wanted/expected that to continue? Instead, the data shows that homes in Seattle appreciated only 4.69%, a small-to-moderate gain among a nation of markets with falling values (a home purchased at $400,000 a year ago with annual appreciation of 4.69% would now be worth $418,760). Back to the article: Just five of the 20 cities the indices track posted year-over-year increases, while all 20 declined from August to September. The 20-city composite dropped by 4.9 percent from the prior year and 0.9 percent from…Read more

-

Suze Orman Sells Seattle

October 23, 2007 /How’s that for a catchy headline? Well, if you’re a follower of Oprah, you might have caught the reference. In a recent show, which aired 10/18/07, Suze dresses down a California couple whose lavish lifestyle has driven them off a financial cliff. As she outlines her prescription for their recovery (a process she refers to as financial detox), Suze's suggestions take an unexpected turn toward Seattle. “Suze's final step is the most drastic. Suze tells Felice and Phil they must sell their California home and move to Seattle, Washington. With a booming housing market and high-tech industry, Suze says Seattle is particularly well suited to both Felice and Phil's strengths—Phil is a computer contractor and Felice was once a mortgage broker.” Now, if you live in Seattle, you probably aren’t surprised to hear about yet another Californian preparing to migrate to our fair city. But this isn’t just another LA escapee; this is Seattle as a recipe for financial survival. And if you’re in the market for a Seattle home, you’re probably wondering why Seattle would specifically be mentioned by any responsible financial consultant - and particularly one of Suze’s national stature. Given the “Subprime Meltdown”, the “Mortgage Morass”, and…Read more